The Strait of Hormuz is internationally important, where President Jimmy Carter first articulated this position in January 1980, following the Islamic Revolution in Iran and the Soviet invasion of Afghanistan. “Any attempt by an outside force to gain control of the Persian Gulf region will be regarded as an assault on the vital interests of the United States of America.”

Numbers and figures indicate that 30 per cent of the world oil demand is provided by Persian Gulf producers, and 20 per cent of global oil passes Strait of Hormuz to reach the markets and consumers. Persian Gulf has 60 per cent of world’s proven oil reserves and 40 per cent of world’s proven natural gas reserves.

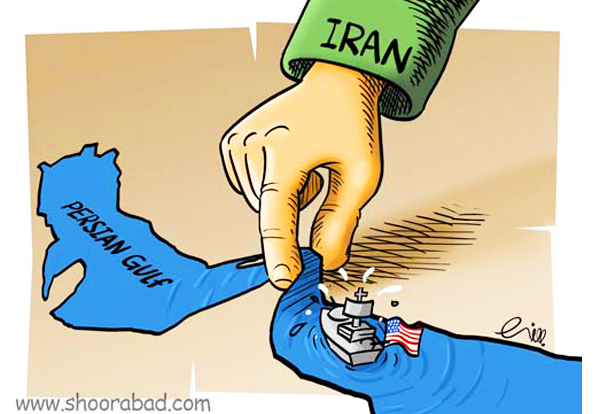

The importance of the issue was testified to by European countries’ attempts to open negotiations with Iran after 6 months of oil sanctions, to which Iran responded with closing the Strait of Hormuz, which according to geography, governs it for decades, in the case that Europe puts sanction on the country’s Central Bank and nuclear program. What is obvious is that closing the 54km Strait would not be possible with iron rods and physical barricades, and the only way to close the strait would be military blockade, which would itself trigger military clash and raise the oil prices up to $ 300. This would bring about another ‘oil shock’ in history. These possibilities have pulled US war ships to Persian Gulf, ready for any confrontations.

The Imaginary Pipeline

Arabs have always watched out themselves, let alone when their national interests areat stake. When Iran responded the EU by closing the Strait of Hormuz, the Arabs played their wining cards: repairing and operation of an old pipeline, which had been abandoned for long and had not transferred oil. Saudi, UAE, and even Iraqi authorities have considered using their pipeline instead of oil transfer through the Strait of Hormuz; which is impossible even in dreams.

Transfer of 17m barrels of oil dwarfs transfer of maximum of 3m barrels of oil, which Arabs forgot in their show-up. Currently, UAE and Saudi Arabia have launched attempts to bypass the strait by rebuilding their old pipelines and construction of a new pipeline (Habshan–Fujairahoil pipeline), but these two pipelines would transfer 3 to 3.5m barrels of oil daily to world markets, thus bypassing the strait. Iraq, with daily export of 2 to 2.2m barrels of crude oil would only transfer 20 to 25 per cent of this volume through Jordan and Turkey to markets. However, it seems that at least on paper, Arabs scenarios to bypass the strait would be viable, and with the smallest blockade of the strait, Saudi Arabia, Qatar, UAE, Kuwait, and Iraq, and even Oman, if blockade extend to Sea of Oman, would not be able to deliver their LNG and oil to world markets.

Strait of Hormuz; not to be bypassed

Closing the Strait of Hormuz would mean blockade of 17m barrels of oil daily to world markets, that is, 20 per cent of world oil demand cut would raise the oil price extremely; an event which had happened with only a military drill. The issue of strait closure had many analysts express their reactions. For example, former Managing Director of National Iranian Tanker Company,who has led Iranian oil tankers for 20 years in the Persian Gulf and knows the process, believes that UAE could noteven dream of bypassing the strait. “With building only a pipeline, the strategic and golden strait of the world would not be bypassed,” Mohammad Souri says. “Currently, the building of a new pipeline, Habshan–Fujairahoil pipeline, is economically motivated, and should not be seen as politically loaded, that is, UAE authorities have acted in decreasing the costs of sea transport of oil from other UAE regions to Fujairah port cityby building this pipeline,” he adds.

Definitely, experts and skilled analysts of the world well know that building a pipeline would not suffice bypassing most strategic and golden Strait of Hormuz. The fact should not be forgotten that not only 20 per cent of black gold demand of world markets passes through the strait, but also LNG-carrying tanker ships, petrochemical products, and other goods pass the strait en route to world markets. This fact suffices to know that in the event of closure of the strait, Qatar would accept large damages. Qatar exports 77m tons of LNG to customers including Japan, South Korea, India, China, Europe and eastern Asia through the strait annually. So, clearly Qatar would not be able to transfer this volume through pipeline with capacity for only 1.5 to 2m barrels daily and bypass the strait.

Closure of Strait of Hormuz, an unending nightmare for the west

Closure of the strait has been a nightmare for oil consumers such that research institutionshave beenpublishing the results of their assessments to find a way to have the signatories of the [sanction] agreements, who have seemingly signedthem with their eyes closed. A website which specializes in oil has predicted rise in oil prices up to $ 300 in the closure of the strait. “Though the prediction may seem rather hyperbole, but realizationof only half of thepredicted amount will send US economy back to crisis,” it wrote.

According to estimations by International Monetary Fund, any barricadeon oil supply to markets would raise its price $ 20 to 30 per barrel.

The International Energy Agency has also predicted that Iranian oil provides 9 per cent of Indian oil demand,6 per cent of that of China. These two countries account for 34 per cent of Iran’s total exports. From 2.5m barrels of oil exported by Iran, 500,000 barrels go to Europe daily, and the remaining barrels are exported to China, India, South Korea, and Japan. If even these countries lower their oil imports from Iran in line with US will, total demand would exceed total supply, leading to rise in oil prices. Analysts believe that Iran does not have enough military might to fully block the Strait of Hormuz, but it can hinder the passing of vessels from the strait, thus raising the oil price. US claims that it would prevent any strait closure; but analysts say that closure would bring considerable implications for global economy, some believing that oil price would rise $ 50 per barrel within days; a thing unprecedented in the history of oil.

Reuters also reported that pipeline carries 4.5m barrels of oil daily to world markets, and 35 per cent of tanker-transferred oil passes through the Strait of Hormuz. According to reports of International Energy Agency, pipelines are slow and expensive. The Agency has stated that it is ready to use strategic reserves such as the Libyanone, but it has not specified how much oil it could supply. Some report says it can supplyapproximately 14m barrels daily. But what is clear is that EU and the west still have concerns over closure of the strait, and only a naval drill would suffice to raise the oil price to more than $ 111. It isa matter of time to see what measures EU would take to pass this strategic water way.

SH/EA

MNA

END

Your Comment